How to Create a Budget As a Self-Employed Sex Worker

One of the most common questions I’m asked as an accountant for self-employed sex-workers – besides How do I pay less in taxes? – is “How do I create a budget when my income varies so greatly?”

If you’re paid a wage that remains the same month after month, it’s fairly easy to work out a budget that remains consistent, too. Much of the time, rent (or your mortgage) and utilities will be the biggest chunk of your budget, so you would begin there and continue to break it down.

But for strippers and other self-employed sex-workers, this isn’t always so easy. I would suggest actually working backwards, so that you know that your budget is realistic and suits the lifestyle you’re actually living.

In other words, look at what you’re consistently spending, and make sure your inflow is adequate.

Bringing in less than you’re spending? Rethink your budget.

Start by printing out or downloading your last three to six months of bank and credit card statements, and grab several colors of highlighter, crayons, or colored pencils. Use one color to first highlight your rent and utilities (gas, water, electric).

Next, another color to highlight your food spending (you can break this down by groceries and take-away if you want to, or use one color for both). Use a third color to highlight your phone bill(s) and any recurring monthly services (internet, streaming, cable, apps, gym).

Next, another color for your gas, ride shares, or transit use. You might need another color to highlight medical expenses like health insurance and medication.

If you have kids, highlight all of their related expenses in another color; you can do the same for pet-care if you have pets. These should be all of your core expenses, and we can always add more categories depending upon what applies to you.

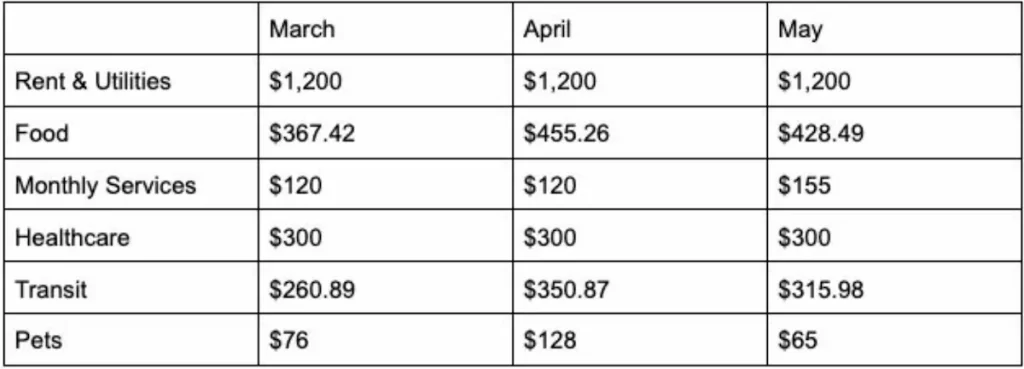

Get your totals for each of those categories, for each of the three to six months you printed out. You can use a table like the one below to make it easier to look at all of the data at once:

In this example, our Rent & Utilities as well as our Healthcare remain stable, so we can safely assume we can start there. The next stable expense is going to be our Monthly Services, provided that $155 represents services we’re going to continue to pay for. $1,200 + $300 + $155 = $1,655, thus far.

Food, Transit, and Pets are all categories that vary, so we’re going to take an average of each by adding across the rows and dividing by 3.

In this example, we get:

Rent & Utilities: $1,200

Food: $417.06

Monthly Recurring: $155

Healthcare: $300

Transit: $309.25

Pets: $89.67

Total: $2470.98

Let’s say that in an average month, you make $4,000 dancing and $500 on OnlyFans. You put $1,350 aside for taxes, and you have $3,150 left. This can comfortably cover your monthly expenses, and you might be able to start a new budget category: Savings.

In ideal circumstances, savings should cover at least a few months’ worth of necessary expenses like the ones we’ve listed above. If you wanted to be able to cover 3 months’ worth of the expenses we’ve listed above, you’d be looking at putting aside roughly $7,500. If you don’t have any outstanding credit card debt or other pressing concerns, you can start aggressively working towards your savings goals.

If you have debt to pay off, especially high-interest debt, it may or may not be more advantageous to pay that off before starting on your savings!

I’ll leave you with one of my favorite pieces of advice for both time and money…